Canadians Risk Being Underinsured: Majority of Drivers Fail Car Insurance Literacy Quiz

September 01, 2020 (PRLEAP.COM) Business News

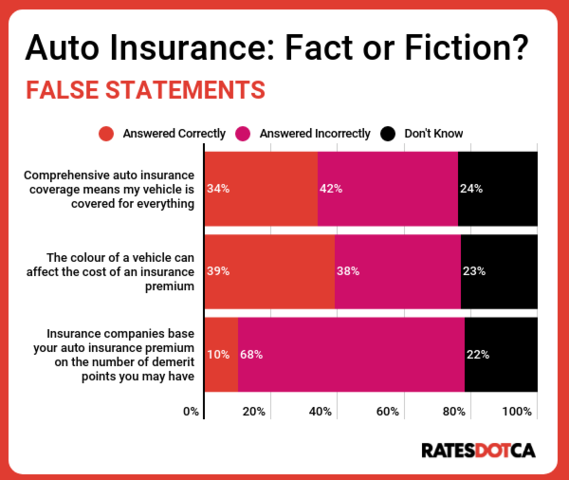

TORONTO, SEPTEMBER 1, 2020 – RATESDOTCA finds the majority of Canadian drivers scored an 'F' on a recent nationwide auto insurance literacy survey, meaning that they may be at risk of overpaying for premiums or worse, be underinsured. The survey asked seven common questions that drivers consider when securing vehicle insurance and found on average almost three (2.6) out of seven questions were answered correctly, with 9 per cent of Canadians incorrectly answering every statement.Here are some of the surprising results:

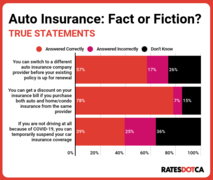

More comforting to learn was that 78 per cent of Canadians knew that they can receive a discount on their insurance bill if they bundle their auto and home/condo insurance and more than half (57 per cent) are aware they can switch auto insurance provider before their policy is due for renewal.*

"As Canadian drivers, the more we understand about auto insurance, the more likely we will get the coverage we need at a fair price and avoid disappointment when filing a claim for damages," says Liam Lahey, Insurance Editor, RATESDOTCA. "For example, although the name may be confusing, comprehensive insurance is an optional coverage you can add to your policy. It covers damages resulting from certain risks or perils such as theft, vandalism, and falling or flying objects but does not cover damages resulting from a collision."

Auto insurance can be confusing and difficult to understand. To help Canadians, Lahey offers these tips to Canadians who want to learn more about their auto insurance policies:

The survey's findings also reveal: In some cases, the older, the wiser

To review the survey's findings, visit RATESDOTCA.

About the Survey

An online survey of 1,513 Canadians was conducted by Leger Marketing from August 7 to 10, 2020, using Leger's online panel. The sample's ages ranged from 18 to 55+ years old. The margin of error for this study is +/-2.5%, 19 times out of 20.

*Answers from respondents in Manitoba and Saskatchewan, which have public insurance regimes, were excluded from two of the seven questions that did not apply to them.

About RATESDOTCA

RATESDOTCA is Canada's leading rate comparison website that offers a quick and simple digital experience to compare the widest selection of insurance and money products in the market. Get a better rate on car, home, and travel insurance, mortgage, and credit cards all in one location. RATESDOTCA aims to help Canadians make better insurance and money decisions so they can save time and money to spend on what really matters to them. @RATESDOTCA

-30-

For more information or to arrange an interview, please contact:

Tracy Truong, Proof Inc. for RATESDOTCA

ttruong@getproof.com

(416) 602-7072

Cameron Penner, Proof Inc. for RATESDOTCA

cpenner@getproof.com

(416) 969-2705