RATESTDOTCA Survey: Almost four in 10 Canadians are confident they can predict interest rates five years into the future

November 10, 2020 (PRLEAP.COM) Business News

Toronto, ON, November 10, 2020 – In what may be a challenging year for many Canadians struggling financially, a recent money intelligence survey from RATESDOTCA - released on the 10th anniversary of Financial Literacy Month - reveals that consumers have a weak understanding of mortgages. Thirty-eight per cent of Canadians feel confident that they can predict interest rates five years from today, according to the second annual RATESDOTCA Financial Literacy Survey. However, experience has long shown that interest rates are unpredictable and mistiming is costly, suggesting that confidence in one's predictive abilities may result in choosing the wrong mortgage.

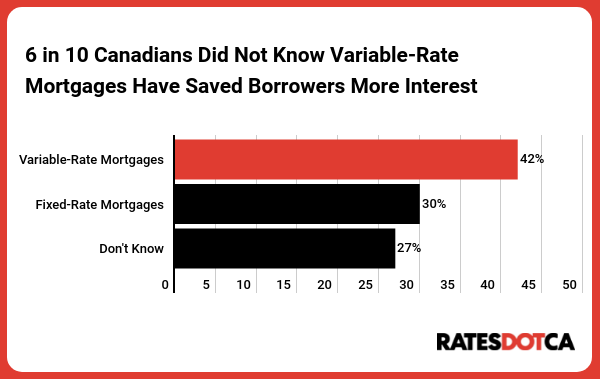

The survey also revealed that six in ten (57 per cent) Canadians did not know that variable-rate mortgages have saved Canadians more money than fixed-rates, when asked, "historically speaking, which type of mortgage do you believe has saved borrowers more interest?" In fact, research indicates that variable-rates outperform fixed-rates over the long-run, with fixed-rates outperforming only a minority of the time and mainly at the trough of economic cycles.

"Once again, data suggests that millions of Canadians have misconceptions that can lead them to choose more expensive mortgages," said Rob McLister, mortgage expert at RATESDOTCA. "Having a baseline awareness of key mortgage facts can reduce borrowing costs by thousands of dollars."

Other findings include:

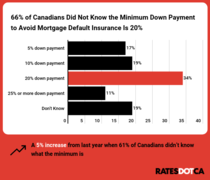

• Canadians are somewhat unclear when it comes to understanding minimum mortgage down payment requirements, as it relates to avoiding mortgage default insurance. Surprisingly, 36 per cent of Canadians believe that a 10 per cent down payment or less would avoid mortgage default insurance, whereas, in reality, 20 per cent is the minimum. As a result, many of these borrowers may be surprised when they have to pay a large premium and higher payments due to the mandatory default insurance being tacked onto their mortgage.

• When asked "what is the most important consideration when choosing a mortgage?", 44 per cent of Canadians chose interest rates, followed by 19 per cent saying 'total borrowing cost over the term', 16 per cent choosing 'term', and four per cent selecting 'contract restrictions.' For qualified borrowers, total borrowing cost is generally the most important consideration with a mortgage. This is concerning as it indicates borrowers may be distracted by less important factors. RATESDOTCA provides detailed feature information so consumers can compare mortgage offers overall, not just rates.

The survey also shows that the majority of Canadians prioritize paying down their mortgage debt. When asked what they might do with an unexpected cash windfall (salary increase, bonus or inheritance), almost six in ten (58 per cent) said they would likely apply this money toward their mortgage. This suggests that many are ignoring opportunity costs when prioritizing the psychological benefits of a paid-off home. Strong financial literacy skills would take into account a number of factors to determine if new funds could be better leveraged elsewhere.

"If you run into unexpected money, what you really want to know is, where can I earn the best risk-adjusted return on this cash? Over the long run, investing discretionary cash in a two per cent mortgage yields too low of a return, relative to the after-tax rate of return in an RRSP or TFSA, for example," says McLister.

"If your time horizon is long enough, today's ultra-low-rates and the time value of money usually mean you're better served by paying your mortgage with future "devalued" dollars and investing today's dollars in assets that grow faster than the rate of inflation."

To review the survey's findings, visit RATESDOTCA.

About the survey

The second annual RATESDOTCA Financial Literacy survey was conducted by Forum Research between September 24-Oct 1st, 2020 and polled 1,179 respondents across Canada with a margin of error of +2.85%. The sample's age ranged from 18 to 65+ years old. Survey questions were presented via telephone and respondents provided answers through the touchpad of their mobile device or home phone.

About RATESDOTCA

RATESDOTCA is Canada's leading rate comparison website that offers a quick and simple digital experience to compare the widest selection of insurance and money products in the market. Get a better rate on car, home, and travel insurance, mortgage, and credit cards all in one location. RATESDOTCA aims to help Canadians make better insurance and money decisions so they can save time and money to spend on what really matters to them. Headquartered in Toronto, RATESDOTCA is located at 360 Adelaide Street West, Suite 100, Toronto, Ontario, M5V 1R7. @RATESDOTCA @RobMcLister

For more information or to arrange an interview, please contact:

Tracy Truong, Proof Strategies for RATESDOTCA

ttruong@getproof.com

(416) 969-2664

Cameron Penner, Proof Strategies for RATESDOTCA

cpenner@getproof.com

(416) 969-2705