Price Markets (UK) launches Price Dynamic MT4 (MetaTrader 4) with multi-bank FX liquidity

September 25, 2013 (PRLEAP.COM) Business News

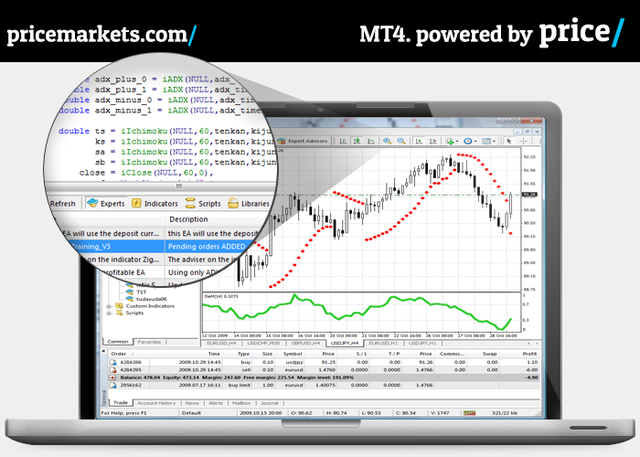

City of London, September 25, 2013 - Price Markets, a trading name of London Capital Group, launches its new Price Dynamic MT4 desktop trading solution adding to its current suite of market leading and extensive range of customised trading applications such as Price MetaTrader 4, Price DealingScreen and Price Markets Currenex ECN which provide traders and investors around the world with powerful execution, analysis & research tools via desktop (Windows, Linux & Mac) and mobile (iPhone, iPad and Android) devices.Ed Anderson, Head of FX Sales at Price Markets said: "With the global launch of Price Dynamic MT4, powered with pricing from our pool of multi-bank FX liquidity providers as well as competitive pricing on Commodity and Index CFDs, we are facilitating the demands and requirements of our clients and the industry as a whole. With Price Markets clients can trade FX, Precious Metals, Energy and Indices on the customised Dynamic MT4 with dynamic spreads and institutional FX pricing derived from Price Markets Currenex ECN."

Anderson added "Price Markets is an experienced provider of ECN connectivity to professional traders and financial institutions via Price Markets Currenex, HotSpotFXi, ICAP EBS and a number of other institutional ECN venues - we now provide the same institutional-grade liquidity directly to any FX (Forex) trader on the popular MT4 platform. Essentially this means that individual traders can now trade on the same pricing and liquidity as larger institutions."

The Forex market is vast, with an estimated 5.3 trillion USD transacted every day (according to the latest BIS survey – April 2013), making it the largest financial market in the world. As Forex transactions are not conducted on an exchange, like traditional shares, clients rely on their provider to source competitive trading prices from their Liquidity Providers.

Anderson concludes "although pricing is of great importance to all traders, the delay between servers communicating with each other, also known as latency, is probably of greater importance. Latency affects the speed our clients get executed at when they trade and speed will affect price discovery and trading opportunities. We host our main European MT4 servers near London which is where Currenex's servers are also hosted. This proximity hosting results in minimum latency in pricing and trade execution between our MT4 servers and the Currenex servers."

Contact: Ed Anderson - Head of FX Sales - +44 (0)20 3290 00 88

About Price Markets (UK)

Price Markets is a trading name of London Capital Group (LCG), which is authorised and regulated by the Financial Conduct Authority. Price Markets provides award-winning trading technology and global access to over 3,000 markets including FOREX, Commodities, Indices, Shares, Bonds and Interest Rates via desktop, web-based and mobile trading applications. LCG's client funds are held in segregated accounts with four of the largest UK banks in accordance with FCA client money rules and client deposits, up to £50,000 per client, are also protected under the FSCS (Financial Services Compensation Scheme).

For more information, go to www.pricemarkets.com.

Institutional FX products are available to Professional/Institutional clients as classified by the FCA and may not be covered by any regulatory protection. Spread betting and CFD trading carry a high level of risk to your capital and can result in losses that exceed your initial deposit.

Contact Information

Ed Anderson - Head of FX Sales

Price Markets (UK)

+44 (0)20 3290 00 88

Contact Us

Ed Anderson - Head of FX Sales

Price Markets (UK)

+44 (0)20 3290 00 88

Contact Us