Senior Housing - Crowdfund Investing in Commercial Real Estate's Top Performing Sector

July 09, 2015 (PRLEAP.COM) Business News

LENEXA, KANSAS, July 9, 2015 — Bridge Capital Management, LLC, a pioneer in Senior Housing commercial real estate crowdfund investing, unveiled an innovative private equity fund allowing accredited investors to participate side-by-side with Bridge Capital Management in vetted Senior Housing development projects in select U.S. markets. This first-of-its-kind investment approach specific to the Senior Housing asset class represents a groundbreaking way for individuals to participate at a lower capital threshold, leveraging the expertise of an experienced asset management firm all while maintaining ultimate transparency and earning expected above-market returns. Founded by a former Accenture executive and seasoned commercial real estate portfolio asset manager, Senior Living Fund aims to provide a powerful alternative to existing investment options.

"Senior Living Fund exemplifies investor empowerment and represents a major step forward for individuals to create wealth through unmet demand in the healthcare and senior housing verticals," said Dan Brewer, Senior Living Fund, LLC founder and Managing Member. "Our platform removes a long-standing antiquated investment approach to premium assets such as newly developed Senior Housing Developments.."

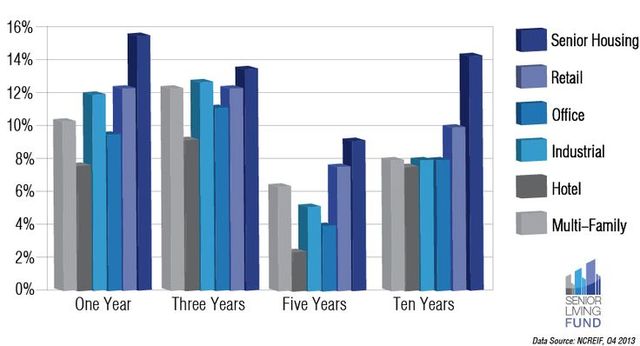

The Senior Housing vertical serves as an ideal investment vehicle for long-term investors seeking competitive risk-adjusted returns with the added benefit of participating in commercial real estate's best consistently performing asset class over the past decade. The inherent premium nature of Senior Housing investment is tied to two integral components, first being the rapidly aging baby boomer population increasing demand and the second the shortage of quality senior care and housing facilities in many markets. The largest generation in U.S. history is retiring en masse, and as things stand now, America lacks the senior housing inventory to accommodate them. A staggering 10,000 Baby Boomers turn 65 every day - this means incredible demand for everything from independent living to assisted living to skilled nursing with full-time nurses.

The essence of early stage investment in senior housing development projects maximizes returns by only working with proven operators in markets that are underdeveloped. A typical ground up development project takes on average 48 to 60 months from entitlements to stabilization, significant value and income is created in short order with proper execution.Investing based on demographic trends is a long-term strategy. But investor patience is rewarded as internal rate of returns are typically in the mid to high teens. Exit strategies are sound as properties are in high demand when stabilized and are typically refinanced or sold.

"In the past the senior housing niche has been dominated by institutions and REIT's. The individual investor typically did not have access to these types of deals due the specialty of operations. We are changing all that now so individual investors can also participate in these opportunities" said Dan Brewer. " No longer is senior housing investment the sole domain of institutions."

Through Senior Living Fund's proprietary cloud-based investment dashboard, registered and approved accredited investors can manage the entire life cycle of their investments including the platform's innovative paperless investment process to review due diligence documents, digitally sign subscription agreements and commit to an investment from anywhere at any time.

About Senior Living Fund, LLC

Senior Living Fund is a senior housing specific commercial real estate crowdfunding private equity firm. The Lenexa, Kansas-based firm is changing the face of commercial real estate investing through the first-of-its-kind innovative crowdfunding platform allowing accredited investors to create wealth through investment in new senior housing development projects. Visit www.SeniorLivingFund.com for more information.